SASSA Payment Dates for 2024 (Officially Confirmed for May)

Grant Payments Confirmed for May: SASSA Payment Dates for 2024

The latest SASSA Payment Dates for 2024, including those for May 2024, have just been released by the Social Security Agency of South Africa.

Be the first to get your social grant dates, for the SASSA old age grant payment date to child support and disability grant dates, in the table below.

You can also see how much your SASSA payment is in the table below.

Check All the SASSA Payment Dates For 2024 Confirmed for May

SASSA Old Persons, Child Support & Disability Grant Payment Dates

| Month | Group | Date |

|---|---|---|

| May 2024 | Old Age Grant Payment Date | Friday 3rd May |

| May 2024 | Disability Grants | Monday 6th May |

| May 2024 | Child Support Grants | Tuesday 7th May |

| May 2024 | Other SASSA Social Grants | From 28th to 31st May |

| May 2024 | SASSA R350 Grants | SRD Grant Payments For May 2024 Can’t Be Collected From the Post Office Any Longer – Find Out Where To Get Your SASSA R350 Grant Payments here |

Whilst SASSA processes grant payments for beneficiaries by the second day of the month, no payments are made on weekends.

Furthermore, these grant payment dates should not be confused with the SASSA R350 Grant which has no set payment date.

For SRD beneficiaries, go here to do your SASSA status check for 350 payment dates

Payment Dates for Foster Child, Care Dependency, and War Veteran’s Grants

SASSA payments dates for the following grants:

- Foster Child Grant

3rd April 2024. - Care Dependency Grant

4th April 2024. Grant - War Veteran’s Grant

5th April 2024.

All of the above grants will be paid on 5th April 2024.

Please note that it can take up to three days for grant payments to reflect in your bank account, especially for different banks, and if the payment was made just before a weekend.

Beneficiaries registered to receive the R350 SRD grant can see where to collect their payment here once they have been notified by SMS.

If you aren’t sure whether you are registered to receive your grant payment, you should do your SASSA Payment Status Check now for an immediate response.

How Much is SASSA Payment

-

- SASSA Old Persons Grant: R2,090

-

- Old Age Grant (75 years and older): R2,110

-

- Disability Grant: R2,090

-

- War Veterans Grant: R2,090

-

- Child Support Grant: R510 per child

-

- Child Support Grant (Top-up): R510 + R250

-

- Care Dependency Grant: R2,090

-

- Foster Care Grant: R1,180 per child

-

- Grant-In-Aid: R510

-

- Social Relief of Distress Grant: R350

Collecting SASSA Payments

When it comes to collecting your money on the correct SASSA payments dates, please remember that you do not have to collect your grant payment on the actual grant date as published above.

SASSA assures grant recipients that there is no requirement to withdraw their grant payment as soon as the funds are made available as the money will remain in the beneficiary’s account.

Whilst it’s understandable that many beneficiaries are under extreme pressure to get their money and cannot wait another day, for those who can wait it’s better not to rush to collect your grant payments immediately.

So if you can wait a day or so, below are two reasons not to rush to get your SASSA payments.

2 Reasons Not to Collect Your Grants on the Published SASSA Payments Dates

-

- Avoid long queues:

Even though your payment is ready to collect you can avoid long queues at the SASSA payment points.

This will save you wasting time, sometimes a whole day, to get your payment.

- Avoid long queues:

-

- Your grant money won’t disappear:

Your money will remain in your account until you withdraw it.

So you do not have to worry about it disappearing from your account if you don’t go to collect it on the day it becomes available.

- Your grant money won’t disappear:

These reasons will hopefully give you peace of mind and make the collecting of your grant much less stressful than going on the exact grant payment dates.

For more information on SASSA Grant Payments and to get access to all SASSA forms click here.

PS. If you haven’t been paid, or your application has been denied, you can appeal this decision with SASSA.

Go here to find out how to submit your SASSA Appeal

Guide to Safe SASSA Grant Collection Points

Safe places where SASSA beneficiaries can collect their grants every month:

- Retail Outlets:

Beneficiaries can collect their grants at several retailers across the country.

These include:

– Pick n Pay

– Shoprite

– Boxer

– U-Save

– Checkers

– Selected OK Food stores

– Usave stores - Bank ATMs and Post Bank (at the Post Office):

Beneficiaries can also collect their grants from bank ATMs and the Post Bank at the Post Office. - Mobile Cash Pay Points:

You can go to any of the mobile cash pay points that have been made available for grant beneficiaries to collect their money. - SASSA Pay Points:

You can also collect from SASSA pay points which can be found in rural areas where access to other collection points is difficult.

And these pay points are safe for beneficiaries to go to and are often guarded during grant distribution days to endure your safety – when you carry cash there’s always a risk of being robbed. - Bank Payments (EFT):

If you have a bank account this is one of the most efficient ways of getting your grant payments as the money will be paid directly into your account which you can access anytime you need. - Spaza Shops:

SASSA is working with spaza shops to use as payment points so that your grant payments can be collected easily and more accessible at the local level.

As mentioned above, remember that you do not need to collect your grant on the day it becomes available as the money will remain on your card until you decide to use it – it won’t disappear.

Another useful tip is to use your SASSA cards for purchases as it reduces the cost for both Postbank and SASSA, and reduces the risk of you being robbed as you won’t be carrying around cash.

SASSA Contact Information for R350 Grants

If you have any queries regarding your SASSA Grant Payments Dates, you can use any of SASSA’s contact details below to get clarity

SASSA contact number for R350: 0800 601 011

WhatsApp Number: 082 046 8553

SASSA appeal helpline: 0800 60 10 11

SASSA email address: [email protected]

Independent Tribunal for Social Assistance Appeals (ITSAA): 012 312 7727 or 086 216 371

SASSA USSD Number: *134*7737#

Submit Your SASSA 350 Appeal & Get Approved

How to Lodge Your SASSA 350 Grant Appeal

Get your SASSA 350 appeal approved, by following this step-by-step guide.

Furthermore, it’s easy to submit your SRD appeal and get approved to start receiving your R350 grant payments.

Furthermore, the SASSA appeal process exists to allow you to plead your case and potentially secure your SRD grant payments.

So if you’re facing disappointment after your R350 grant application was rejected, remember, you’re not alone.

This in-depth guide will walk you through every step, empowering you to confidently fight for your R350 grant.

If your SRD appeal is successful, you will get the grant for the period of time that your appeal was pending.

And you’ll get any R350 back payments that you are owed.

But, you must be very careful to submit the correct information and documentation.

This will increase your chances of success in getting your SASSA 350 grant appeal processed and approved.

Before You Start Your SASSA 350 Appeal

Understanding the Reasons for Rejection

Before diving into the SRD appeal process, it’s crucial to understand exactly why your application wasn’t approved.

Reasons can vary, so:

- Review the SASSA notification you received to say you were rejected:

It might provide the specific cause. - Contact the SASSA Contact Centre (0800 601 011):

Their agents can offer insights.

Common rejection reasons include:

- Ineligibility:

Double-check if you meet all R350 grant criteria (e.g., citizenship, income requirements). See the full list of requirements to be eligible for the R350 grant below. - Incomplete application:

Ensure all necessary documents and information were submitted correctly. - Missing bank details:

Accurate bank information is crucial for disbursement. - Technical errors:

Ensure you followed the correct application process and deadlines.

Also, before submitting your SASSA Appeal for R350, you should also check your R350 status which may provide more clarity and help you understand why your application got rejected.

You should also know that SASSA SRD grants are for only for those who meet all the eligibility requirements for the R350 grant.

Therefore, before you submit your SASSA appeal, you should check to see whether you meet all the eligibility requirements below.

If there’s any that you don’t comply with, that will probably be the reason why your R350 SRD application got declined.

SASSA R350 Grant Eligibility Requirements that You Must Meet to Qualify

- You must be a South African Citizen, Permanent Resident or Refugee registered on the Home Affairs database.

- The grant is also open to persons who are holders of special permits under the Special Angolan Dispensation, the Lesotho Exemption Permit dispensation and the Zimbabwe Exemption Permit Dispensation, and asylum seekers whose section 22 permits or visas are valid or were valid on 15 March 20201.

- You must be currently residing within the borders of the Republic of South Africa.

- You need to be above the age of 18 and below the age of 60.

- You must be unemployed to get the grant.

- You can’t be receiving any other form of social grant.

- And you can’t be getting an unemployment insurance benefit or qualify to receive an unemployment insurance benefit (UIF).

- You also can’t be getting a stipend from the National Student Financial Aid Scheme (NSFAS) or any other financial aid.

- You can’t be receiving any other government COVID-19 response support.

- You cannot be living in a government funded or subsidised institution.

Therefore, if you meet the eligibility criteria for the R350 grant, in terms of the requirements above, you can proceed with your SASSA appeal.

Common reasons for being ineligible for the grant include;

- failing to meet age requirements

- being admitted into a state institution

- being able to provide for yourself or your dependents

- already receiving a state grant

- applicant deceased

- submitting incorrect documents

- or the intended beneficiary is not in the country.

PS. Caregivers who are not receiving any grant on their own behalf are also eligible to apply for the R350 grant.

Preparing for the SASSA 350 Appeal: What You Need

Remember, for a successful appeal outcome it requires proper preparation and to ensure that you submit complete and correct information.

Here’s what you’ll need to have before you start the appeal process;

- Your South African ID number:

This identifies you throughout the process. - Your phone number:

The cellphone number you used to submit your original application. - The SASSA application reference number:

You can find this number on your initial application acknowledgement. - Any rejection documents:

These confirm the reason for the rejection and might provide some more information on what SASSA still requires from you. - Supporting documents:

Wondering what documents do I need for a SASSA appeal?

Depending on the reason for rejection, you’ll need to get documents like bank statements, proof of income, and proof of address.

It’ll make the appeal submission process easier if you have all the required docs ready to submit with your SRD appeal.

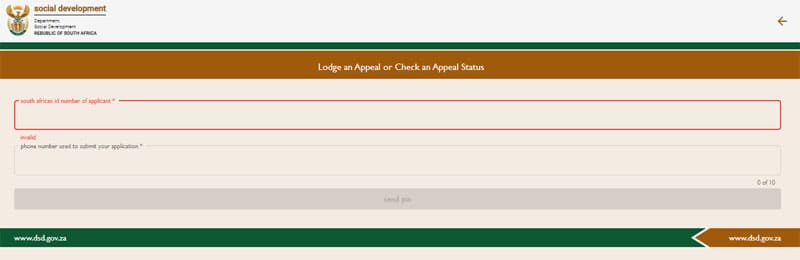

Do You Want to Submit Your SASSA 350 Grant Appeal Online or Offline?

You can choose either of the following ways to submit your SRD appeal, as follows;

- Online:

Visit the SASSA (srd sassa gov za appeal for R350) website and follow these prompts;

- Enter your ID number

- And then the phone number you used to submit your application

- Then click the “Track Appeal” button to check the status of your SRD appeal,

This method is convenient and easily accessible for those who have internet access and are comfortable doing it online.

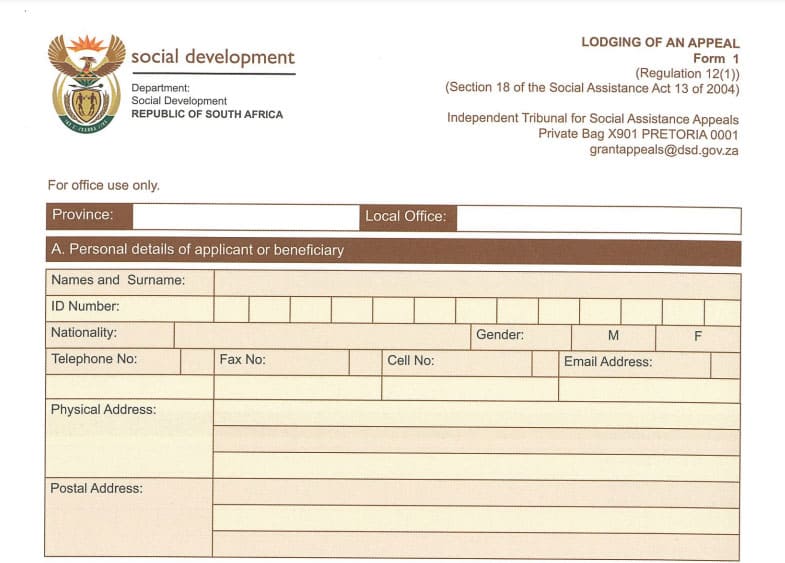

- Offline:

Download the appeal form from the SASSA website, fill it out, and submit it at a local SASSA office.

This method might be preferred if you lack internet access, a computer or smart phone or you need assistance from SASSA staff to complete the form correctly.

If you’re unsure of anything you can contact the SASSA Call Centre at 0800 601 011.

Remember, there’s no need to re-submit your SRD appeal or contact the office again once you’ve submitted it.

You’ll also receive an SMS with the outcome of your appeal and if it is successful, payments will be made starting from the month you first applied.

SASSA Appeal Form

Download your SASSA appeal application form – here in pdf format

Preparing Your Appeal Statement

You might ask whether you need to submit a statement together with your SASSA appeal, and the answer is;

Yes, you need to submit an appeal statement when appealing a rejected SRD grant application.

So no matter whether you do it online or offline, your appeal statement is your chance to convince SASSA to reconsider.

These are some key points to take note of when writing it;

- Be clear and concise:

Stick to the facts and avoid emotional language. - Address the rejection reason:

Don’t try and fool SASSA, but rather directly acknowledge why your application was rejected and explain why it was incorrect or unfair. - Present supporting evidence:

Attach relevant documents to strengthen your case. - Proofread carefully:

Ensure your statement is properly written and doesn’t have any errors or spelling mistakes.

Submitting Your SASSA 350 Appeal

Once you’ve completed your appeal form and statement, submit it through your chosen method (online or offline) within 30 days of receiving the rejection notification.

You must also remember to;

- Meet deadlines:

If you submit your appeal after the closing date it might be automatically rejected. - Keep a copy:

You will need to keep a personal copy of your appeal and supporting documents in case you need to refer to it in the future or to get your appeal approved.

Tracking Your Appeal Status

After submitting your SASSA appeal online or by going to a SASSA office, you will need to wait quite a while to hear back from them.

This is because you won’t get a result quickly as the processing time usually takes 30-60 days.

But here’s a useful tip for you…

You can check the status of your appeal online using your ID number and application reference number on the SASSA website here.

You can also go here to find out how to check your SASSA appeal status.

Appeal Outcome: Approved or Declined?

Once your appeal is processed, you’ll receive notification via SMS or online through your SASSA account.

The possible outcomes can be any of these;

- Approved:

Congratulations! Your appeal was successful, and you’ll receive your R350 grant payments. - Declined:

Unfortunately, your appeal wasn’t successful and the notification might give you reasons for the decision. - Pending further information:

SASSA might require additional information before making a final decision which is a good outcome as it would seem that you just need to give them additional information to get your grant.

What are the Next Steps in the Appeal Process: What Happens if an Appeal is Declined

What you do next depends entirely on the outcome of your appeal especially if it was denied.

- Approved (Great result for following the SASSA appeal process correctly):

If your appeal was successful you can enjoy your well-deserved R350 grant payments that you’ll soon be getting. - Declined (What if your appeal gets rejected?):

Wondering what you can do if your appeal was rejected?

Don’t worry there’s still something you can do if your appeal was unsuccessful.

So don’t lose hope.

You can still appeal your appeal outcome.

It’s your right to appeal their decision.

You can submit it to the Independent Tribunal for Social Assistance Appeals (ITSAA) within 30 days.

Start by going to their website here.

Contact Information for your SASSA Appeal

If you have any queries regarding your SASSA appeal for your R350 grant or request for reconsideration, you can use any of SASSA’s contact details below to get clarity

SASSA contact number for R350 appeal: 0800 601 011

SASSA appeal helpline: 0800 60 10 11

SASSA appeal email address: [email protected]

Independent Tribunal for Social Assistance Appeals (ITSAA): 012 312 7727 or 086 216 371

5 SASSA Appeal Tips

Here are some important SASSA appeal tips to increase your chances of winning a SASSA grant appeal:

- Be sure to submit all the SASSA appeal documents required.

- Explain your case clearly and concisely in your letter of appeal.

- Be honest and accurate in your appeal form.

- If you get the opportunity, you should attend your appeal hearing in person, do so.

- If you have any questions or concerns, contact SASSA for assistance.

How Long Does a SASSA Appeal Take?

It will take about 60 to 90 days to get the outcome of your SASSA R350 grant appeal.

After you submit your appeal, an Independent Tribunal for Social Assistance Appeals (ITSAA) will review your case to ensure that SASSA did not miss any important information.

Just to recap, here is a breakdown of the appeal process:

- You submit your appeal form and supporting documentation.

- The ITSAA reviews your case and may contact you for additional information.

- The ITSAA (Independent Tribunal for Social Assistance Appeals) makes a decision on your appeal.

- The ITSAA notifies you of the outcome of your appeal in writing.

SASSA Appeal Success Rate

The SASSA appeal success rate is difficult to determine, as SASSA does not publish this data.

However, based on anecdotal evidence and reports from social justice organizations, it is estimated that the SASSA appeal success rate is between 10% and 20%.

And it seems that the SASSA appeal success rate can vary depending on the reason for the grant rejection and the quality of the appeal.

For example, those appealing a SASSA decision who have strong evidence to support their case and who have submitted a well-written appeal letter, are more likely to be successful.

We hope this information is helpful & wish you good luck with your SASSA grant appeal!

Furthermore, those who can attend their appeal hearing in person, are also more likely to be successful.

Therefore, if you are considering appealing a SASSA grant rejection, it is important to understand the appeal process and to gather all relevant documentation.

You may also want to seek legal advice or assistance from a social justice organization.

Also take a look at the SASSA appeal tips above before submitting your appeal so that you have the best chance of getting an approval & not a rejection.

Final Advice On Your SASSA Appeal

- If you’re still waiting for your application to be approved, or for your payment, you can do your SASSA status check for R350 here.

- Got a “pending” response to your application or any other query?

Go here for answers to the most Frequently Asked Questions about the SASSA SRD Grant - Waiting for a payment?

Go here to see all the latest SASSA payments dates - But if you’ve already received a “declined” or “rejection” notice then you should start the process to lodge your SASSA appeal online as shown above.

Troubleshooting Common Issues With Your SASSA Appeal Status Check

If you’re having problems with your SASSA appeal status check the following troubleshooting guide should help you solve any issue you’re having.

Unable to Access the SASSA Appeal Portal

- Login issues:

If you’re having trouble logging in, double-check your username and password.

If you can’t remember them, click “Forgot Password” and follow the instructions to reset it.

If that doesn’t fix it, try clearing your browser cache and cookies or using a different browser. - Technical errors:

Some temporary glitches can occur.

Try refreshing the page, opening it in a new tab, or restarting your device.

If the error persists, contact SASSA for technical support. - Browser compatibility issues:

Ensure you’re using a recent browser version like Chrome, Firefox, or Safari. Check your browser’s compatibility information if you’re facing issues.

And make sure you’re using the latest, updated version of your browser.

Some of your Documents are Missing to do your SASSA Appeal

- Contact SASSA to explain your situation and inquire about options for obtaining replacements or temporary substitutes like affidavits or official statements.

- Provide any available documentation related to the missing document, such as police reports or proof of attempts to acquire it.

SASSA Appeal for R350 Declined

- Carefully review the appeal rejection notice to understand the specific reason.

- Consider addressing the reason by gathering additional supporting evidence or rephrasing your arguments for resubmission.

- Seek guidance from legal aid resources or community organizations if needed.

Your Appeal Process Delayed

- Understand that complex appeals or high volumes at SASSA can lead to delays.

- Monitor your SASSA profile for updates and avoid submitting duplicate appeals.

- Contact SASSA through their official channels for inquiry about your appeal status, providing your reference number.

Appeal Timeline

- Estimated timelines:

While actual timelines can vary, expect approximately: 30 days for initial review, 45 days for further processing, and a final decision within 60-90 days. - Factors affecting timelines:

Complexity of your case, workload at SASSA, and need for additional verification can influence the timeframe. - What to do during waiting periods:

Gather any additional evidence, prepare for potential follow-up questions, and stay updated on official SASSA communications.

FAQs: SASSA SRD Appeal

You can appeal if you: disagreed with the initial SASSA decision, believe your application contained misinformation, or experienced significant changes affecting your eligibility.

You can appeal based on: income verification issues, incorrect information in your application, changes in family circumstances, or technical errors during application.

You have 30 days after receiving the SASSA decision to submit an appeal.

Required documents include: your ID, proof of residence, bank statements, income verification documents, and any evidence supporting your appeal grounds. Optional documents like medical certificates or legal affidavits can strengthen your case.

How-to-Guide to do your SASSA Appeal Status Check

Use your ID number and password to log in or register if necessary.

Choose the reason for your appeal from the listed options.

Provide accurate and detailed information, including the date of the initial decision, your appeal grounds, and supporting evidence.

Ensure all files are scanned clearly, without password protection, and within the stipulated size limit.

Carefully review and check the information before submitting. Once submitted, you cannot edit it, but you can submit additional evidence later if needed.

Links to Additional Resources

- SASSA Status Check for R350 Payment Dates (2024)

- SASSA R350 Grant Application Online

- Latest News On SASSA R350 Grant 2024/2025

- SASSA Grant Payment Dates

- For more information on your right to lodge an appeal for your SRD grant go to the SASSA Appeals page here (https://srd.dsd.gov.za/appeals/), where you can lodge an appeal or check the status of your appeal.

SASSA Status Check for R350 Payment Dates (2024)

350 Grant Status Check: Quick & Easy

This is exactly how to check your SASSA Status for R350 Payment Dates and to see your grant payment dates.

It’s quick & easy to do your SASSA R350 grant application status check via SMS, the Mojo App, and the SASSA website and app (below).

Breaking News:

The R350 SRD grant, will be increased by 5.7% on April 1, 2024, from R350 to R370 per month.

This was announced by Finance Minister Enoch Godongwana in March 2024.

This SASSA status check procedure applies to both new & existing SRD grant beneficiaries.

This means that even if you’ve already applied, and approved, you must still do your 350 grant status check regularly to make sure you’re still registered.

So let’s show you how to check SASSA R350 grant status online with any of these 3 quick and easy ways below.

How to Check Your SASSA R350 Status

(3 Easy Ways)

The following 3 ways to do your sassastatuscheck for R350 payment dates, are all very quick and easy to do.

And you will be able to see whether your application is pending, approved or whether you are registered or de-registered.

1 Do Your SRD Status Check Online On the Official SASSA Website

- The first thing to do to Check Your SRD Status, is to go to this link: srd.sassa.gov.za/sc19/status

- When the page opens you need to enter;

1. Your ID Number

2. And then the Cell Phone Number you used when you applied for the SRD grant.This will start the SASSA Status Check process.

- The last step is to simply click the “Submit” button and you will get your SASSA Status Check for R350 confirmed to see whether you are registered or not.

2Use Your Cell Phone to Check Your 350 SASSA Status on WhatsApp or SMS or USSD

- Add 082 046 8553 to your list of contacts on your cell phone.

- Then send a WhatsApp message with just one word, “status”

- After that’s done you’ll be prompted to enter your ID number and the cell phone number you used when you applied for the R350 SRD grant.

- You will then receive a response with your SRD status.

- USSD SRD code to check status:

Dial the USSD code provided by SASSA from your mobile phone (*134*7737#) and follow the instructions to view your application status.

3How To Check SASSA Status With the Moya App

Using the #datafree Moya App is another useful way to check your SRD status.

- It’s a free download, free to use as well as being #datafree, meaning that you can use it’s features, including messaging, even if your own data has run out.

- Not only will it show you how to check your SASSA status, but you can also use the Moya App to check your balance.

- Go to this link to see how to Download the Free Moya App and how to set it up to check your SASSA status.

PS. If your SRD status check shows that your application has been declined, you’ve still got time to submit your appeal for the R350 grant to get paid in the same month.

How to check your SASSA 350 payment dates?

There are two ways to find out your next SASSA R350 payment date:

- Check Online:

Go to the official SASSA SRD website here: https://srd.sassa.gov.za/

Then enter your South African ID number and the phone number you used to apply for the SRD grant in the first place.

Then click “Submit.”

You’ll see your payment status immediately, and if approved, the estimated payment date.

- Contact SASSA Call Center:

Call the hotline: 0800 601 011.

Choose your preferred language.

Select the “Check SRD R350 Status” option.

Follow the prompts and provide your information.

Then a SASSA agent will help you check your payment status.

PS. Remember that payments are usually sent, or made available, on different dates each month.

So you should check your status again after 30 days to get the actual payment date.

Lastly, make sure all the information you submit is correct otherwise you won’t get an accurate response.

SASSA Grant Payment Dates Released for March 2024

SASSA Old Persons, Child Support & Disability Grant Payment Dates

| Month | Group | Date |

|---|---|---|

| May 2024 | Old Age Grant Payment Date | Friday 3rd May |

| May 2024 | Disability Grants | Monday 6th May |

| May 2024 | Child Support Grants | Tuesday 7th May |

| May 2024 | Other SASSA Social Grants | From 28th to 31st May |

| May 2024 | SASSA R350 Grants | SRD Grant Payments For May 2024 Can’t Be Collected From the Post Office Any Longer – Find Out Where To Get Your SASSA R350 Grant Payments here |

SASSA Contact Details for R350 SRD Grant

- Got queries regarding your SRD status check for your R350 payment?

- Or you’ve been approved but still no payment?

- Use any of the SASSA contact details below to get clarity

SASSA Toll-Free number for SRD R350 queries: 0800 60 10 11

WhatsApp Number: 082 046 8553

SASSA Tel helpline (landline): 012 400 2000

SASSA USSD Number: *134*7737#

SASSA SRD email address: [email protected]

Postal Address: Private Bag X55662, ARCADIA, 0083 SRD email address: [email protected]

Independent Tribunal for Social Assistance Appeals (ITSAA): 012 312 7727 or 086 216 371

SASSA R350 Grant Requirements: Latest Eligibility Criteria (2024)

Before doing your SASSA status check for R350 payment dates, you should check to see that you are one of those who qualifies for SASSA r350 grant.

If you don’t, that could be a reason why your 350 status check is giving a rejected or declined response or you just haven’t got your latest payment.

Below, are the latest eligibility requirements for 2024;

SASSA R350 Grant Eligibility Requirements that You Must Meet to Qualify

- You must be a South African Citizen, Permanent Resident or Refugee registered on the Home Affairs database.

- The grant is also open to persons who are holders of special permits under the Special Angolan Dispensation, the Lesotho Exemption Permit dispensation and the Zimbabwe Exemption Permit Dispensation, and asylum seekers whose section 22 permits or visas are valid or were valid on 15 March 20201.

- You must be currently residing within the borders of the Republic of South Africa.

- You need to be above the age of 18 and below the age of 60.

- You must be unemployed to get the grant.

- You can’t be receiving any other form of social grant.

- And you can’t be getting an unemployment insurance benefit or qualify to receive an unemployment insurance benefit (UIF).

- You also can’t be getting a stipend from the National Student Financial Aid Scheme (NSFAS) or any other financial aid.

- You can’t be receiving any other government COVID-19 response support.

- You cannot be living in a government funded or subsidised institution.

Therefore, if you’re a person who qualifies for SASSA R350 grant according to the latest eligibility criteria, you can proceed with your SASSA status check.

Common reasons that your status may be declined include these below;

- failing to meet age requirements

- being admitted into a state institution

- being able to provide for yourself or your dependents

- already receiving a state grant

- applicant deceased

- submitting incorrect documents

- or the intended beneficiary is not in the country.

PS. Caregivers who are not receiving any grant on their own behalf are also eligible to apply for the R350 grant.

7 Ways You Can Apply for the R350 SRD Grant Online

So, if you meet the eligibility criteria for the R350 grant, and you haven’t applied yet, you can apply in one of the following ways;

- SASSA website: https://srd.sassa.gov.za/

- Email: [email protected]

- WhatsApp: 082 046 8553

- USSD line: Dial 1347737# and follow the prompts

- GovChat

- How to submit your R350 SASSA application online

SASSA R350 Grant FAQs (Everything You Need to Know)

To check your SASSA R350 grant status online, you can visit the SASSA website and click on the “Application Status” tab. You will need to enter your ID number and phone number to check your status.

To check your SASSA R350 grant status via WhatsApp, you can save the SASSA WhatsApp number (082 046 8553) to your contacts and send a message that says “Status” followed by your ID number. For example: “Status 1234567890123”.

To check your SASSA R350 grant status via SMS, you can send an SMS to 082 046 8553 with your ID number in the message. You will receive an SMS response with your grant status.

There are two ways to find out your next SASSA R350 payment date:

- Check Online:

Go to the official SASSA SRD website here: https://srd.sassa.gov.za/

Then enter your South African ID number and the phone number you used to apply for the SRD grant in the first place.

Then click “Submit.”

You’ll see your payment status immediately, and if approved, the estimated payment date.

- Contact SASSA Call Center:

Call the hotline: 0800 601 011.

Choose your preferred language.

Select the “Check SRD R350 Status” option.

Follow the prompts and provide your information.

Then a SASSA agent will help you check your payment status.

Remember:

Payments are usually sent on different dates each month.

You can check your status again after 30 days.

Lastly, make sure all your information is accurate.

The different SASSA R350 grant status messages are:

- Pending: Your application is still being processed.

- Approved: Your application has been approved and you will receive your grant payment soon.

- Declined: Your application has been declined.

- Cancelled: Your grant has been cancelled.

The reasons why your SASSA R350 grant application may be declined are:

- You are not eligible for the grant.

- You have already received a grant from another source.

- You have provided incorrect information on your application.

- You have failed to re-apply for the grant on time.

To be eligible for the SASSA R350 grant, you must meet the following criteria:

- You must be a South African citizen, permanent resident, or refugee.

- You must be above the age of 18 and below the age of 60.

- You must be unemployed and not receiving any other social grant.

- You must not be receiving a student bursary or grant.

- You must not be receiving an unemployment insurance benefit.

- You must not be receiving any other form of government assistance.

You can go to this link to apply for the SASSA R350 grant online or on the SASSA website, or via the Moya App.

To apply online, you will need to visit the SASSA website and create an account. Once you have created an account, you can log in and start the application process.

Go to this link to download the Moya App for free.

Once you have downloaded the app, you can create an account and start the application process.

You can check your SASSA R350 grant status online at the SASSA website, WhatsApp, SMS, or via the Moya App. (see the 3 Ways To Do Your SASSA Status Check above)

To check your status online, you will need to visit the SASSA website and log in to your account. Once you have logged in, you can click on the “Application Status” tab to check your status.

To check your status via the Moya App, you will need to open the app and log in to your account. Once you have logged in, you can click on the “Check Grant Status” button to check your status.

The different SASSA R350 grant status messages are:

- Pending: Your application is still being processed.

- Approved: Your application has been approved and you will receive your grant payment soon.

- Declined: Your application has been declined.

- Cancelled: Your grant has been cancelled.

The reasons why your SASSA R350 grant application may be declined are:

- You are not eligible for the grant.

- You have already received a grant from another source.

- You have provided incorrect information on your application.

- You have failed to re-apply for the grant on time.

If you have any questions or problems with your SASSA R350 grant application, you can contact SASSA customer support for assistance.

About the “status pending message”, SASSA said it happens when there’s a delay in payments for the new cycle

Payments could also be suspended, if the qualifying criteria had changed.

Furthermore, more than one payment could be made in a single month, but no one would receive a double payment for their R350 grant.

You should, therefore, continue to check your SASSA status until you no longer get the “SASSA status pending” message.

The SASSA R350 grant has been extended until March 2025, as announced by President Cyril Ramaphosa at the 2024 SONA.

If you have already applied, do your SASSA status checking until you have a confirmation that you’ve been registered (as above).

Many more will qualify, for instant caregivers, for the SASSA R350 grant payments.

The SASSA R350 grant is available as part of the COVID-19 Social Relief Of Distress Fund.

If you qualify you’ll still need to apply for the social relief grant which can be done by using any of the methods below.

The SASSA reconsideration application gives you an easy way to submit your request.

Go to this link to see how to submit a reconsideration request or submit an appeal.

Before you would’ve had to send your reconsideration application via email to [email protected].

But now it’s much easier and quicker to do online.

The quickest way to do a SASSA Reconsideration Status Check is to go to the official website. (https://srd.sassa.gov.za/sc19/reconsideration)

Once the page has opened you will just need to do the following;

- Enter your South African ID Number in the top block

- Enter the phone number you used in your original application

- Then click “Send Pin” or just hit enter.

- Once you have your PIN sent back you can proceed with your SASSA reconsideration application.

This is another common complaint from SRD grant applicants who have received an approved SMS but have not been paid.

The reason for this is generally a bank verification problem where your records do not match those on file at the bank.

Whilst a few banks have had account complications, to be safe, you should also check that the bank account details you supplied are correct.

If you are rejected for the SASSA SRD grant, you can appeal the decision.

To appeal the decision, you must submit a written appeal to SASSA within 30 days of the date of the rejection letter.

Follow these steps to submit your SASSA Appeal Online

Once you have submitted your appeal you should receive an SMS from SASSA notifying you of the outcome.

Or you can find out how to check your SASSA appeal status here.

You can also reach out to SASSA on their call center number at 0800 601 011.

SRD Grant Payments Will No Longer Be Available At Post Office Branches and there are currently no fixed SRD Grant payment dates for 2023.

Therefore, you won’t be able to collect payments from Post Office branches from June 2022 in order for SAPO to reduce the number of people queuing for grants.

But, as an SRD grant beneficiary, you can have payments deposited into your bank account, or collect them from certain retail stores.

You can’t collect your SRD SASSA payments for R350 from Post Office branches, but you can get them from the supermarkets and retail stores below.

- Pick n Pay

- Boxer

- Shoprite

- Checkers

- USave merchants

However, before going to collect your payment from one of the supermarkets above, you need to set up your preferred payment option, as below.

- Firstly, you must have your own cellphone number to be able to receive your R350 payment at one of the supermarkets above.

- Then log on to srd.sassa.gov.za.

- Once you’ve logged in, you must respond to the security SMS you receive on your phone to proceed.

- Once that’s done, you can then choose the merchants in your application from where you want to collect your money.

- Once you’ve made your choice, submit the updated application.

In addition, you need to have your own cellphone number so that you can receive your grants at supermarkets.

Lastly, you will also be helped with resetting your PINs for your SASSA cards at the pay points.

Old age, disability or child payments can still be collected from any Post Office branch.

Go to the following link to see more answers to the most popular SASSA SRD Grant FAQ here.

For example, answers to questions like these;

The Social Relief of Distress Grant (SRD Grant) is available to South African Citizens, Refugees, Asylum Seekers and Special Permit Holders who are between the ages of 18 and 60 years. And the above group must also have insufficient means, who do not receive social grants on behalf of herself/ himself or who are not eligible for UIF payments, and have no financial support from any other source.

Hoe Doen n Mens Jou SASSA R350 Grant Status Tjek?

Dit is baie vinnig en maklik om te doen.

Daar is basis 3 maniere om jou SASSA R350 status tjek te doen, soos volg;

1. Gaan na die amptelike SASSA website (srd.sassa.gov.za/sc19/status) en volg die instruksies.

Sodra die website oopgemaak het, volg net hierdie stappe;

i) moet jy eers jou ID-nommer intik,

ii) en dan die selfoonnommer wat jy in jou oorspronklike aansoek gebruik het,

iii) druk dan die “submit” knoppie.

2. WhatsApp of SMS

3. Laai die Moya-App en doen dit daar.

Jy kan ook aansoek doen vir die R350 grant op die Moyo App wat gratis is.

En laastens, gaan na die paragraf hierbo waar jy 3 maklike maniere kan sien om jou SASSA R350 Status tjek te doen met al die inligting: “How to Check SASSA R350 Status: 3 Easy Ways”

Afrikaans FAQs

Daar is 3 maniere om jou sassa status tjek te doen, soos volg; WhatsApp, Mojo-app of om na die amptelike SASSA website te gaan. Of jy kan net hierbo sien hoe om dit te doen.

Hier is all die SASSA Kontakinligting;

WhatsApp: 082 046 8553

E-pos: [email protected]

USSD-Nommer: *134*7737#

SASSA-Inbel sentrum nommer: 0800 60 10 11

SASSA-webwerf: https://srd.sassa.gov.

More Useful Information For SASSA SRD Grant Beneficiaries

- My application is still pending

- I’m waiting for reconsideration

- I was declined

So, once you’ve done your SASSA status check you’ll be able to see the status of your application and then you can rectify it before the next payment date.

For example, if you get declined, you can appeal the decision for reconsideration.

You should also note that if you’ve missed a R350 payment date, you should contact SASSA to arrange your payment.

Also, you should be notified by SMS as to when your SASSA payment is ready for collection if it’s not paid directly into your account.

However, this is assuming you still qualify for the grant for that particular month as your qualifying criteria could’ve changed.

It’s very important to do a SASSA status check for R350 payment every month to verify that you still qualify for the SRD grant payment

Final Advice On Doing Your SASSA Status Check for R350 Payment Dates

- Whilst you should do a SASSA status check for R350 payment dates every month, SASSA says there are no longer any fixed payment dates.

- This means that each month your application will be verified to ensure that you still qualify for the R350 SRD grant.

- Those who have been verified and qualify for the SRD grant, they will be paid each month.

- Furthermore, grant applicants need only to submit just one SRD grant application.

Also, if you see that you’ve been approved but haven’t received your money, it probably means that your payment is yet to be processed.

But, you’ll need to wait for your SMS from SASSA to confirm that your payment is ready to collect.

Lastly, as a South African, I see many homeless people sleeping on the streets of Cape Town and other parts of the country who clearly need assistance.

These are the poorest of the poor whose lives could be drastically improved if they were properly informed of the SRD Grant.

I suspect many of them aren’t even aware of it.

- So if you know of anyone who makes less than R624 per month, please tell advise and help them to submit their applications for the R350 grant

- And once they’ve applied, tell them how to do their 350 Status Check to confirm that they are registered.

Getting R350 a month may seem nothing to most of us, but to the poorest of the poor it could be a life-changing gift.

Therefore, let’s ensure that those poor South Africans who deserve the SRD grants, are informed and made aware that they could qualify to receive them.

Loans for Debt Review Clients: The Truth

Loans For Debt Review Clients In South Africa: Understanding the Challenges and Solutions

The truth about getting loans for debt review clients is that it’s not only impossible through reputable channels but it’s also prohibited in terms of the National Credit Act (NCA) in South Africa.

Therefore, even if you’re under debt review and need a loan urgently, you will not legally be able to secure a loan or additional credit.

However, once you have completed the debt review process and obtained a clearance certificate, you are no longer under debt review and you will be free to legally secure loans and additional credit again.

Furthermore, if you’re wondering “where to get a R5000 loan even if u under debt review” granting this kind of loan still won’t be granted to debt review clients.

Even payday loans are prohibited for debt review clients.

Why Can't I Get a Loan While Under Debt Review

Here are some of the reasons why loans for people under debt review are prohibited from being granted;

- The National Credit Act prohibits financial institutions from offering loans to individuals under debt review.

- Although you may not realise it when you urgently need a loan, this regulation protects you and the lenders by ensuring responsible lending practices so you don’t get deeper into debt.

- When you’re under debt review, you’re actively managing and consolidating existing debts.

- Imagine getting additional loans while under debt review, your financial situation would worsen and most likely lead to deeper debt making your life miserable.

- Even consolidation loans for debt review clients are off the table and do not play any part in the debt review process.

Solutions for Clients Suffering Under Debt Review

While loans for debt review clients are off the table there other solutions that you can generate some extra money from to alleviate your financial hardship during the debt review process.

- Apply for a SASSA Grant:

As one of the many debt review clients in South Africa, you are allowed to apply and get social grant payments as long as you meet the eligibility criteria set by the South African Social Security Agency (SASSA).

You can also apply for the R350 SRD Grant. - Sell Unused Items:

Declutter your belongings and consider selling unwanted items online through platforms like Gumtree, Facebook Marketplace, or local classifieds.

This can be a quick way to generate some extra cash while decluttering your space. - Freelance or Piece Work:

Explore freelance, side hustles, or piece job opportunities that offer flexible schedules and remote work possibilities.

Platforms like Upwork, Fiverr, or Freelancer.com offer a variety of remote projects that can be done in your spare time. - Develop and Sell Crafts or Skills:

If you have a creative skill or talent, consider selling handmade crafts, artwork, or offering personalized services on online marketplaces like Etsy or through social media platforms. - Become an Online Tutor:

If you have expertise or good knowledge in a specific subject, offer online tutoring services to students.

Platforms like TutorMe or Chegg connect tutors with students seeking academic support.

Remember, to always be transparent with your debt counsellor:

Regardless of your chosen income-generating activity, always be open and transparent with your debt counsellor.

They can ensure that your choice to earn extra money complies with the debt review regulations and doesn’t jeopardise your progress.

So despite loans for people under debt review being prohibited, you do have some really good options to earn some extra money to make ends meet.

Coping with Financial Challenges During Debt Review

Managing your finances under debt review can be challenging, but here are some coping strategies.

- Create a realistic budget:

Track your income and expenses to identify areas where you can cut back. - Prioritize essential needs:

Focus on essential expenses like housing, food, and utilities while managing other expenses creatively. - Communicate openly:

Be transparent with family and friends about your financial situation and don’t spend money trying to impress people. - Seek emotional support:

Struggling for money to get by every month is emotionally draining and depressing.

Therefore, talking to trusted individuals or seeking professional counselling can help manage stress and anxiety. - Payday loans for debt review clients:

Do not be tempted to look at payday loans as they are also prohibited for debt review clients.

Furthermore, do not fall into the trap of looking for debt relief in the form of getting credit from loan sharks.

They’ll make your life a misery and make debt review seem like a walk in the park compared to the hell they’ll put you through.

Please seek emotional support (above) or reach out to one of the organisations below for assistance.

Understanding Your Options During Debt Review

While being unable to apply for loans while under review may seem unfair during financial hardship, remember that debt review is a temporary measure to help you regain financial control.

Here are some alternative solutions to consider:

- Contact Your Debt Counsellor Immediately:

Debt review clients have a personal debt counsellor whom than can reach out to for guidance and counselling.

See below, what your debt counsellor can do for you.

They’re also there to discuss available options and help you understand the implications of seeking additional credit while under debt review. - Negotiate existing loan repayments:

Contact your creditors and discuss extending repayment terms or lowering interest rates within the debt review plan.

You can probably do this with the help of your debt counsellor. - Seek financial counseling:

Professional guidance can help you manage your budget, prioritize debts, and explore alternative avenues for financial stability. - Explore government support programs:

Depending on your circumstances, you might be eligible for government support programs offering financial assistance and resources.

How Long Does Debt Review Last

How long debt review takes in South Africa depends on various factors, but it usually takes 3 to 5 years for most people under debt review to complete the program.

While there’s no exact time frame to determine how long debt review lasts, here’s a breakdown of the factors that can affect how long it takes:

1. Total Debt Amount:

The larger your total debt, the longer it will take to repay it through the consolidated monthly payments in the debt review plan.

2. Affordable Repayment Amount:

The amount you can realistically pay towards your debt each month significantly impacts the time it will take to become debt-free.

Higher affordable repayments lead to a shorter completion period.

3. Negotiating Terms:

The negotiation process with creditors impacts your repayment terms, such as interest rates and repayment period.

Favorable negotiation results can potentially shorten the overall debt review duration.

4. Adherence to the Plan:

Consistent adherence to the agreed-upon monthly payments is crucial.

Missing payments can lengthen the program due to potential penalties or adjustments to the repayment plan.

5. Unforeseen Circumstances:

Unexpected events like job loss or medical emergencies might require adjustments to the repayment plan, potentially impacting the overall duration.

Therefore, the 3 to 5 year timeframe for how long you stay under debt review is just a general guideline.

However, you must remember that how long your debt review lasts can be shorter or longer depending on your specific circumstances and commitment to the program.

Here are some additional points to consider:

- Consulting your Debt Counselor:

They can provide a more personalized estimate of your debt review duration based on your current financial situation and the negotiated terms with your creditors. - Focus on Completion:

Completing the debt review program successfully can significantly reduce how long you stay under debt review and improve your financial stability and credit score in the long run.

Being Under Debt Review Will Come to an End

Remember, debt review is a process, not a permanent state.

And it’s there to help you get out of debt and live a normal life where you can get credit to buy things like appliances, a car, or even a house.

Therefore, by using available resources, staying committed to your plan, and practicing responsible financial management, you can successfully navigate this period and achieve financial stability in the long run.

You will get through this successfully as long as you do not lapse into getting loans from dubious lenders who can make your life a misery.

How to Get Debt Review Clearance Certificate

Getting your debt review clearance certificate in South Africa involves completing the following steps:

1. Fulfill Your Debt Review Obligations:

- This is the essential step, requiring you to make all your monthly debt review payments in full and on time throughout the agreed-upon program duration.

- Ensure all fees associated with the debt review process are settled.

2. Communication with Debt Counselor:

- Once you’ve completed all your obligations, communicate with your registered debt counselor to initiate the clearance certificate process.

- They will verify your completion and gather the necessary documentation.

3. Processing by Debt Counselor:

- Your debt counselor will prepare and submit the clearance certificate to all relevant credit bureaus in South Africa.

4. Credit Bureau Updates:

- The credit bureaus will update your credit report to reflect your completion of the debt review and remove the “debt review” flag.

This process can take several weeks depending on the individual bureau’s procedures.

Additional Considerations:

- How long does it take to get a clearance certificate:

While there’s no guaranteed timeframe, receiving your clearance certificate can take several weeks to a few months due to processing by both the debt counselor and credit bureaus. - Patience:

Be patient and allow time for the administrative process to complete. - Communication:

Maintain contact with your debt counselor for updates and any required actions. - Independent Verification:

After a reasonable wait, consider contacting credit bureaus directly to verify the update of your credit report.

Remember, getting your clearance certificate signifies the completion of your debt review program and it’s an important step towards rebuilding your financial well-being.

Debt Review Success Stories

If you’re feeling overwhelmed by being under debt review, these success stories of normal South Africans who have successfully completed the review process will give you hope.

Success Story 1: Thandi Shares her Story to Break the Shame of Being Trapped in Debt

Thandi, a single mother of two young children in Soweto, found herself drowning in debt after a series of unfortunate events.

With limited income and mounting expenses, she felt hopeless.

After struggling for months on her own, Thandi’s sister suggested debt review – a process Thandi had heard negative things about.

Desperate, she reluctantly contacted a registered debt counselor.

The process wasn’t easy.

Thandi faced additional challenges due to her community’s reliance on informal lending practices.

Budgeting every cent and learning to live within her means required major adjustments.

However, with her counselor’s support and her family’s encouragement, Thandi persevered through feelings of shame and the stigma that followed.

Three years later, Thandi received her clearance certificate.

You can just imagine the relief she felt after that huge weight was lifted from her shoulders.

Not only was she debt-free, but she had empowered herself with financial knowledge.

Today, Thandi shares her story to break the shame of constantly being in debt and struggling to make ends meet and offers guidance to others in her community.

Success Story 2: Sipho, a Young Entrepreneur from Alexandra Township

Sipho saw his dreams of making it big in business fading away as he got deeper and deeper into debt.

After a bad investment, the community that believed in him started to doubt whether he was clever enough to run a successful business.

Sipho began to feel the pressure to succeed, not only for himself but also for those who had placed their faith in him.

Besides, his business desperately needed money to survive and going under was just not an option for Sipho.

Can you imagine the shame and humiliation he would’ve felt, not to mention not having money to live on either?

But despite the shame and fear of failure, Sipho confided in a mentor, who encouraged him to seek professional help.

With guidance from a debt counselor, Sipho enrolled in the debt review program.

Negotiating with creditors was challenging, but Sipho used the little business acumen he had to explore additional income streams.

And then, after four years, Sipho walked out of the debt counsellor’s office with his debt review clearance certificate.

Now, with financial responsibility woven into his business model, Sipho is a role model in his community.

He advocates for financial literacy and helps fellow entrepreneurs build resilient businesses rooted in sound financial practices.

Success Story 3: The Overwhelmed Family

The Mazibuko family, living in a township near Cape Town, found themselves overwhelmed by rising costs and debt from unforeseen expenses.

Both parents worked tirelessly, but their income couldn’t keep up with payments and the stress of drowning in debt that mounted each month.

Concerned about their children’s futures, they visited a financial advisor in their community who referred them to a debt counselor.

While apprehensive at first, the debt counsellor helped them understand the potential benefits of debt review in breaking the downward spiral of debt and financial hardship.

The review process required huge sacrifices, but with patience and unwavering support from one another, they learned to budget, reduce unnecessary spending, and prioritize financial well-being.

After five years, the Mazibukos received their clearance certificate.

They faced challenges rooted in systemic issues and struggled with the stigma of financial difficulty, but their commitment and perseverance paid off.

Today, they are financially independent, debt-free, and confident in creating a secure future for their children.

What Your Debt Counsellor Can do for You During Debt Review

You might think that your debt counsellor has the power to arrange consolidation loans for debt review clients, but they’re legally prohibited from arranging any additional credit for their clients.

This conforms with the National Credit Act, which protects lenders and debt review clients by ensuring responsible lending practices.

However, this is what your debt counsellor can do for you;

Instead of consolidation loans, registered debt counselors in South Africa are equipped to offer the following services:

- Debt assessment:

They analyze your financial situation and assess your eligibility for debt review. - Negotiation with creditors:

They have the authority to work for you to secure lower interest rates and extended repayment terms with your creditors.

This consolidates all your existing debts into a single, more manageable monthly payment without taking out a consolidation loan. - Budgeting and financial literacy:

They provide guidance on budgeting, managing finances responsibly, and avoiding future financial difficulties. - Support and guidance:

They offer ongoing support and advice throughout the debt review journey, helping you navigate challenges and achieve financial well-being.

Alternatives to Consolidation Loans for Debt Review Clients

As you can see above, a good debt counsellor can play an important role in making your debt review easier and less of a struggle.

Just imagine negotiating with all your creditors, yourself, to give you a longer time to pay your debt at lower interest rates too.

You wouldn’t be able to do it without a professional counsellor working for you and in your best interests.

More Alternative Solutions for Managing Debt:

While traditional consolidation loans are not available during debt review, other options can help you manage your debt more effectively:

- Get permission from your Debt Counselor to access funds:

Discuss alternative solutions with your counselor.

They might offer guidance on accessing funds within your existing debt review plan (like emergency funds) for unforeseen expenses. - Explore government support programs:

Depending on your circumstances, you may be eligible for government assistance programs offering financial aid (e.g., SRD R350 Grant). - Seek additional income ethically:

Explore authorized freelance work, selling unused items, or developing skills to generate extra income within your available time.

For more help and support, consult a qualified financial advisor for personalised guidance or reach out to anyone on the contact list below.

Contact List of People and Institutions that offer Debt Review Clients Help or Support

Government & Regulatory Bodies

- National Credit Regulator (NCR):

They regulate the debt review industry and provide resources for consumers. You can reach them through their website: https://nationalgovernment.co.za/units/view/126/national-credit-regulator-ncr or call their toll-free number: 0860 44 62 72. - National Consumer Commission (NCC):

They advocate for consumer rights and offer assistance with complaints against credit providers.

You can reach them through their website: https://thencc.org.za/ or call their toll-free number: 0860 134 326. - Department of Social Development (DSD):

They offer financial assistance programs and support for vulnerable individuals and families.

You can find their website here: https://srd.sassa.gov.za/ or contact your local DSD office. - Social Grants:

If you think you may qualify to get a social grant you can go here to check all the SASSA Grant FAQs

Non-Profit Organizations

- The Debt Counselling Alliance of South Africa (DCASA):

They offer information and support on debt review and financial management.

You can find their website here: https://www.ndca.org.za/ - The National Debt Reviewers Association of South Africa (NDRA):

They represent debt counseling companies and provide information on debt review.

You can find their website here: https://www.facebook.com/NCRDC3106/ or contact them via email: [email address removed].

Financial Advisors:

- Registered Debt Counselors:

These individuals can provide personalized advice and guidance throughout your debt review journey.

Find a registered Debt Counselor through the NCR website or contact your debt review provider for recommendations. - Independent Financial Advisors:

While they cannot offer specific advice on debt review, they can provide general financial guidance and assistance with budgeting, saving, and future financial planning.

Additional Resources for people Under Debt Review:

- Debt Review Information Portal:

https://www.ncr.org.za/register_of_registrants/registered_dc.php – A comprehensive resource center provided by the NCR with information on debt review, rights and responsibilities, and frequently asked questions.

When You're Under Debt Review and Need a Loan Urgently, Don't Do This...

Even if you’re under debt review and need a loan urgently do not be tempted to borrow money from a loan shark.

It could be the worst thing you do, for the following 3 reasons;

- Loan sharks will have little regard or sympathy for your desperate financial situation, except to capitalise on it.

- Whilst it may be fairly easy to get credit from a loan shark, it will come with unrealistic repayment terms combined with an unreasonably high-interest rate.

- Failing to make a repayment will probably result in all types of verbal, as well as physical, threats in the event of you missing a payment date.

These guys don’t play, so no matter how desperate you are do not be tempted.

Times are probably tough, but remember you’re only in this situation because of managing your money badly, so do not be tempted to take on additional debt especially from loan sharks.

However, if you’re fed up with the process & think you can manage without being under review, this is how you can get out of debt review.

Last Word on Loans for People Under Debt Review

- In the unlikely event, you find a lender willing to provide loans for people under debt review, look carefully at the interest rate being charged before signing & committing to any loan not being granted by a traditional lender or bank – it will almost certainly place you in a far worse financial situation.

- You should also ensure that the lender is registered with the NCR (National Credit Regulator) which would provide some protection & peace of mind as opposed to some of the unscrupulous lenders out there.

- Furthermore, it’s mostly loan sharks that may consider giving loans to debt review clients in South Africa which may give you some short-term debt relief.

However, please be aware that things can turn nasty and you stand a good chance of losing everything including your car, and home as well as having your salary fleeced which will leave you nothing to live on.

Lastly, if you’re one of the many people under debt review and need a loan urgently, always ensure that the lender (unlikely you’ll find one) is registered with the NCR (National Credit Regulator).

For answers to the questions you may have about the debt review process, how long do you stay under debt review, and other questions, see the most frequently asked questions about debt review below.

Debt Review FAQs

Debt review is a formal process in South Africa to help individuals who are struggling with managing their debts. It involves:

- Negotiating with creditors to lower interest rates and restructure outstanding debt.

- Making a single monthly payment to a debt counselor who then distributes it to creditors.

- Completing the program usually takes 3-5 years depending on the individual’s financial situation.

Read more about What is Debt Review…

The answer is yes & no. Getting traditional loans for people under debt review, through a bank, will not be possible, loan until you have completed the debt review process.

However, you may be successful in getting finance through a less reputable lender.

To qualify for debt review, you must be:

- Over 18 years old.

- Residing in South Africa.

- Unemployed or employed with an income insufficient to meet your debt obligations.

- Unable to afford your monthly debt repayments.

There are various fees associated with debt review, which are regulated by the National Credit Regulator (NCR). These typically include:

- Initiation fee.

- Monthly administration fee.

- Success fee upon completion of the program.

Once enrolled in debt review, all legal action by creditors is suspended. You will no longer receive calls or letters demanding payment. Your debt counselor will negotiate with your creditors on your behalf to lower interest rates and restructure your debt for easier repayment.

No, obtaining a loan of any kind is strictly prohibited for individuals under debt review in South Africa. This regulation protects both lenders and borrowers by ensuring responsible lending practices.

Alternative solutions to consider during debt review include:

- Negotiate with creditors: Collaborate with your debt counselor to discuss extending repayment terms or lowering interest rates within the existing debt review agreement.

- Seek government support: Explore government assistance programs like the Social Relief of Distress Grant (SRD Grant) offered by the Department of Social Development (DSD).

- Generate additional income: Consider authorized freelance work, selling unused items, or developing skills to generate extra income within your available time.

Also, see options to earn extra money while under debt review above (Solutions for Clients Suffering Under Debt Review)

- Registered Debt Counselors:

These individuals can guide you through the process and provide personalized advice. Find one through the NCR website or contact your debt review provider for recommendations. - National Credit Regulator (NCR):

They regulate the debt review industry and offer resources for consumers. - National Debt Reviewers Association of South Africa (NDRA):

They represent debt counseling companies and provide information on debt review.

Once you fulfill all obligations under the debt review program and receive a clearance certificate, you can start applying for new credit again.

However, it’s recommended to wait for a reasonable period to allow your credit score to recover before applying for new loans or credit.

Remember:

Debt review is a legal and regulated process in South Africa that helps individuals manage their debts and regain financial stability.

Engaging with authorized debt counselors and seeking legal guidance is crucial for navigating this process responsibly and ethically.

It’s crucial to prioritize your monthly debt review payment.

However, if you miss a payment, contact your debt counselor immediately. They can work with you to find a solution and potentially restructure your payment plan to avoid falling behind.

International travel for people under debt review may require permission from your debt counselor and the National Credit Regulator (NCR).

They will assess your situation and determine if your travel plans impact your ability to fulfill your debt review obligations.

Inform your debt counselor immediately if you lose your job.

They can assess your situation and help you adjust your debt review plan to accommodate your changed financial circumstances.

Inherited funds are generally not considered your income under debt review.

However, you are advised to consult with your debt counselor to understand how inherited funds might impact your remaining debt review payments and completion timeframe.

Selling assets requires approval from your debt counselor as it might affect your ability to repay your debts.

They will guide you through the process ensuring compliance with the debt review regulations.

While your credit score might take time to recover, completing your debt review program and staying committed to your payment plan will demonstrate positive financial behavior to credit bureaus.

This can contribute to gradually improving your credit score in the long run.

Violating the terms of your debt review agreement, such as taking on new debt without authorization, can have serious consequences. This could include legal action from creditors, removal from the debt review program, and potential damage to your credit score. It’s crucial to adhere to your agreement and communicate any changes in your financial situation to your debt counselor promptly.

Remember, this information is for general guidance only.

Each individual’s situation is unique, and it’s essential to consult with your registered debt counselor for specific advice and support throughout your debt review journey.

All forms of credit will be denied to people under review which includes home loans, personal loans or any additional credit.

No, whatever you do, don’t miss a payment as you’ll risk voiding the agreement.

The consequences of this would be to leave you exposed, without legal protection & at the mercy of your creditors who’ll take action against you.

How to Check SASSA Appeal Status (2024)

Check Your SASSA R350 Appeal Status Instantly

Need to know how to check your SASSA appeal status for the R350 grant?

Or wondering if your appeal got approved or how to check your SASSA appeal status?

This easy guide will show you step-by-step how to check your SASSA appeal status online.

We’ll also give you some helpful tips on what to do if your SASSA appeal is taking longer than expected.

So, whether you just want to check your SRD R350 appeal status for the first time or you’ve done it before, this guide has everything you need to stay informed and up-to-date.

Step-by-Step Guide: How to Check Your SASSA R350 Appeal Status Online

Finding out whether your SASSA appeal for the R350 grant was successful can feel like waiting for an eternity.

But don’t worry!

This guide will walk you through the simple process of checking your status online, leaving you informed and empowered.

Getting Started: What You'll Need to Check Your Appeal Status

Before diving in, ensure you have two things handy:

- South African ID number:

This is your key to accessing your personal information on the SASSA website. - Mobile phone number:

The one you used during the SASSA application process.

- South African ID number:

Also, before you start the process for your SRD Appeal Status Check, it’s probably wise to check your R350 status for clarity.

This will help you understand why your application was rejected.

Furthermore, if your SRD application was declined and you haven’t appealed their decision you can still submit your SASSA appeal for your R350 grant here

Finding Out Your Status: The Step-by-Step Guide

- Navigate to the Official SASSA Website:

Visit the South African Social Security Agency (SASSA) website at https://www.sassa.gov.za/. - Access the Appeals Section:

Look for the “Appeals” section or a similar tab. It might be under “Services” or “Grants” depending on the website layout. - Log in Securely:

Enter your South African ID number and mobile phone number in the designated fields.Click “Login” and follow any additional security prompts.

- Find Your Appeal Status:

Once logged in, search for a section labeled “Check Appeal Status” or “Appeal Outcomes.”Select the relevant timeframe (e.g., “R350 Grant Appeals”) and enter your ID number again for verification.

Click “Submit” and voila! Your appeal status will be displayed.

Understanding the Results of Your Appeal Status: What Does It Mean?

Your displayed status will likely fall under one of three categories:

- Approved:

Congratulations! Your appeal for the R350 grant has been successful.

The website will provide further details on payment schedules and disbursement methods. - Pending:

Your appeal is still under review.

No need to panic, just be patient and wait for updates on the website or via SMS. - Declined:

Unfortunately, your appeal wasn’t successful this time.

However, the website might offer reasons for the decision and information on re-appealing or seeking alternative assistance.

Additional Resources and Support for Your R350 Appeal

If you encounter any difficulties or have further questions, don’t hesitate to consult these resources:

- SASSA Contact Centre:

Call 0800 601 011, Monday to Friday 8:00 AM to 4:30 PM (South African time). - SASSA Social Media:

Follow SASSA on Facebook or Twitter for updates and announcements. - Independent Tribunal for Social Assistance Appeals (ITSAA):

This independent body handles appeals not resolved by SASSA.Visit their website at the Social Assistance Act for more information.

SASSA R350 Grant Eligibility Requirements that You Must Meet to Qualify

You should also know that SASSA SRD grants are for only meant for those who meet all the eligibility requirements for the R350 grant.

Therefore, before you submit your SASSA appeal, you should check to see whether you meet all the eligibility requirements below.

And, if there’s any that you don’t comply with, that will probably be the reason why your R350 SRD application was declined.

- You must be a South African Citizen, Permanent Resident or Refugee registered on the Home Affairs database.